Receive the latest updates on growth and AI workflows in your inbox every week

Procurement professionals focus, rightly so, on cost savings. Their mission in an organization is to find opportunities to maximize contract value through negotiation, clause management, or supplier relationship management.

But they’re missing a key cost-savings vehicle: The contracts themselves.

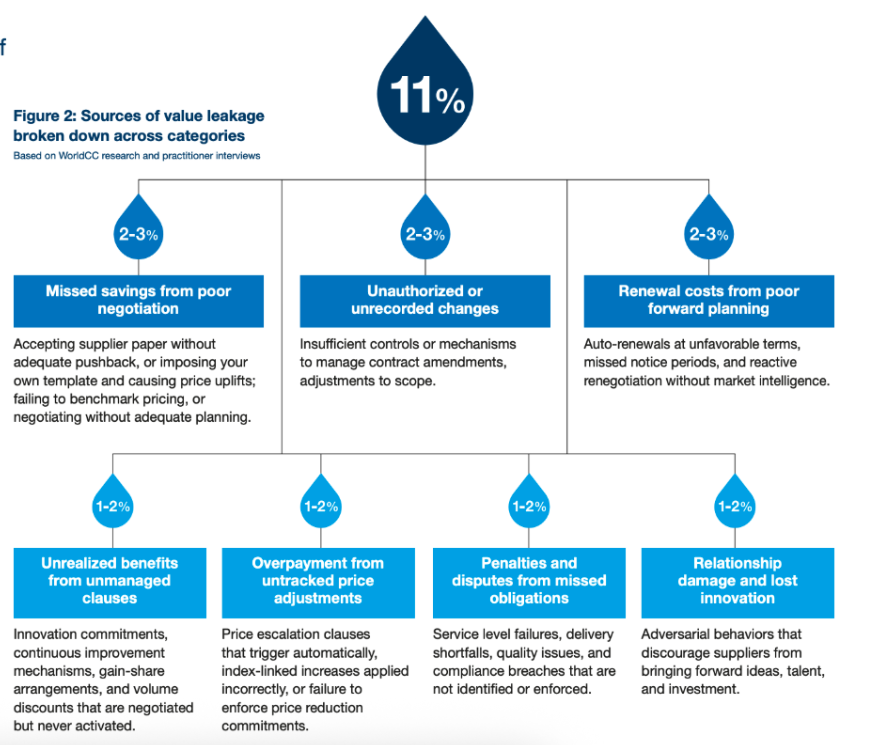

Organizations lose an average of 11% of contract value, according to World Commerce & Contracting. That’s from multiple failure points throughout the contract management process. While a great contract design can’t solve all of the reasons why your contracts may lose value, it can help set your team up for success in the long run as you address larger operational concerns.

Using data from the report we created in partnership with WCC, Closing the Procurement Value Gap: How Smarter Contracting Can Prevent 11% Value Leakage, we’ll talk through why traditional contracts leak value, and what adaptive mechanisms procurement teams can put in place to implement stronger contracts for their businesses:

Why traditional templates leak value

Procurement professionals are constantly challenged to do more with less, in increasingly volatile economic and geopolitical conditions that jeopardize supply chains around the world. Our business cycles move more quickly and require more corporate agility than ever before, and standard templates aren’t rising to meet the moment.

Source: Closing the Procurement Value Gap: How Smarter Contracting Can Prevent 11% Value Leakage

“The pressure here is that we’re becoming more and more dependent on certain countries for our supply chain, and that creates a sense of fragility,” explains Tom Mills, Procurement Protagonist and host of the Procure Bites podcast. “That means we have less options, which means when something goes wrong, whether that’s politically, economically, or even the weather, that can expose our targets and have a real impact on the business.”

In response to an uncertain economy—shifting regulations, supply chain issues, and technological disruption—the first instinct is to add more risk clauses. Rather than managing risk, this only serves to move responsibility to the supplier, and often fails to account for performance or governance.

Inflexible contracts that shift responsibility to the supplier may look great from a legal position, but operationally, they’re difficult to execute, ultimately rendering them ineffective.

This is where contracts begin to leak.

You may be shouldering renewal costs from poor forward planning, overpaying from untracked price adjustments from suppliers, or dealing with increased costs from suppliers in exchange for moving risk.

To fix this, think about adding flexibility back into your contracts:

5 adaptive mechanisms every contract should have

Traditional procurement tactics—fixed prices, aggressive cost-down, passive governance—are no longer sufficient in volatile markets. Buyers need contracts that can adapt to changing circumstances without requiring complete renegotiation, including:

Dynamic pricing that accurately reflects the current market conditions

When vendors lower margins to win, they then strip out quality or collaboration to remain viable. Once profitability collapses, service levels decline, risks increase, and relationships deteriorate. You don’t want to be racing for the bottom. Instead, pricing is one of the leakage areas that you can fix with clauses that accommodate fluctuations in the market.

Prices are no longer static, making it more important than ever to include well-designed price adjustment clauses to protect budgets. This could be:

- Index-linked adjustments: Tie price changes to objective, verifiable indices (CPI, commodity indices, labor indices) rather than supplier-declared cost increases.

- Tariff pass-through mechanisms: Define how changes in import duties or tariffs will be handled, including documentation requirements and verification rights.

- Cost transparency requirements: Require suppliers to provide cost breakdowns and justify significant price adjustment claims with supporting evidence.

- Caps and floors: Limit upward and downward adjustments to prevent unlimited exposure. Typical caps range from 3-5% annually. Two-way adjustments: Ensure that price adjustment mechanisms work in both directions – if indices rise, prices may increase, but if indices fall, prices must decrease.

As you look at your pricing strategy, think about how you’ll adapt as prices change, whether that’s applying a specific index as a base, using a trigger for certain materials, or working more relationally with most-favored customer clauses or volume discounts.

Flexible provisions that accommodate changing business needs

Contracts need build-in flexibility to allow you to scale up and down as the business changes their priorities. To do this, you could include clauses like:

- Volume bands: Define pricing at different volume levels, allowing the relationship to scale up or down without renegotiation.

- Scope variation procedures: Establish clear processes for adding, removing, or modifying scope elements, including pricing and approval mechanisms.

- Change control processes: Define how changes are requested, evaluated, priced, and approved, preventing scope creep while enabling necessary adjustments.

- Technology refresh provisions: For technology contracts, or those where technology is embedded, incorporate new technologies or replace obsolete components.

A contract shouldn’t require a complete renegotiation just because you’re slightly pivoting your business strategy.

Proactive governance triggers to prevent small issues from spiraling

When it comes to risk, understanding who bears what risk and whether it’s actually managed is critical. Risk allocation also carries a price (or a potential discount) depending on the outcome of your negotiations. More importantly, proactive governance prevents small issues from becoming big problems.

Adding these clauses into your contracts can help allocate risk more effectively:

- Scheduled reviews: Build in quarterly or semi-annual reviews of pricing, performance, and relationship health.

- Material change clauses: Define events that trigger a formal review (e.g. change of control, significant market disruption, regulatory change).

- Early warning obligations: Require parties to notify each other of delays, cost overruns and quality concerns before they become problems. Consider a graduated scheme for liquidated damages.

- Escalation procedures: Define clear paths for escalating issues that cannot be resolved at operational level, with specified time frames and decision-makers.

When we focus too much on risk, the customer loses. Remember when evaluating risk to make sure it’s actually managed, because poor performance is poor performance, regardless of who is at fault from a legal perspective.

Value realization mechanisms that you won’t forget about

One of the biggest sources of contract leakage is in opportunity cost. Procurement will spend plenty of hours (and lots of goodwill) for clauses that offer real benefits to the business, only to have them fail to be activated after the signature goes through.

This includes value-driven clauses like:

- Innovation commitments: Has the supplier committed to bringing forward new ideas, technologies, or process improvements?

- Gain-share arrangements: Are savings or efficiency gains shared between the parties? How are they calculated and distributed?

- Exclusivity benefits: If the buyer has committed volume or exclusivity, what benefits flow in return?

- Joint development rights: If the parties collaborate on new products or services, how is Intellectual Property (IP) ownership and commercialization handled?

If you’ve included any of these clauses, make sure they’re being enforced in some way to prevent leakage.

Clean exit provisions for when it’s not working out

Another common source of contract leakage? Renewal agreements that take you by surprise. The ability to exit an agreement cleanly protects long-term leverage. Include clauses like:

- Termination assistance: Require the supplier to provide reasonable assistance during transition to a new supplier, including knowledge transfer and data migration.

- Asset handover: Define what happens to assets, equipment, and intellectual property created during the contract.

- Step-in rights: For critical services, include the right to step in (or appoint a third party) if the supplier fails to perform.

- Data return and destruction: Specify how data will be returned or destroyed at contract end, with certification requirements.

Post-signature, pay attention to when renewal events happen, including your auto-renewal dates and the notice period to prevent renewal. Think of it as the same kind of checkup you do at home for your streaming subscriptions and auto-grocery purchases to make sure you’re still using them.

A CLM can help you build more flexible contract templates

A contract lifecycle management system consolidates all of your standard templates into one place—so you can easily see clause and negotiation patterns over time. A CLM like Ironclad allows you to analyze your contracts for information about specific clauses or help you look for upcoming renewal dates to make sure you’re not missing a re-negotiation opportunity.

When a new contract does come in, Ironclad’s AI can identify non-favorable clauses or suggest preferred language before you need to go over each section with your own red pen. That way you’re well on your way to a flexible, well-designed contract more quickly.

Design contracts with adaptability in mind

Procurement can’t close the value gap alone. In many organizations, procurement has limited involvement in contract governance, performance reviews, or supplier relationship management. These activities fall to operations, project teams, or business units—functions that typically lack commercial training, contractual awareness, or the authority to hold suppliers accountable. A contract with adaptable clauses is one step that can help close this gap.

Designing stronger contracts starts with the understanding that a standard template may, on paper, look like it de-risks your organization—when in reality, it only moves the risk from one party to another, and can still leave your customers disappointed with the end product. To truly de-risk your organization, you need flexible contracts with clauses designed to adapt to today’s volatile market conditions.

Learn more about how to close the value leakage gap by downloading the full report.

Ironclad is not a law firm, and this post does not constitute or contain legal advice. To evaluate the accuracy, sufficiency, or reliability of the ideas and guidance reflected here, or the applicability of these materials to your business, you should consult with a licensed attorney.