Tell us how you landed your role at Plaid.

I am so lucky to be at Plaid, a mission-driven company that is supporting the development of digital financial services. I didn’t ever expect to be at a technology startup, but building teams and organizations is what motivates me. So when Plaid approached me, I jumped at the opportunity to help it grow from startup to steady-state. Plaid also has a mission I support—to unlock financial freedom for everyone—and great, idealistic, motivated people.

What was your “aha!” moment around becoming GC?

There are two things I love about being a GC. First, explaining how we can use law and risk management as strategic levers for success feels satisfying. The second is seeing my team succeed. As corny as it sounds, it moves me to see people on my team solving problems and working together to achieve great things.

What are some key lessons you’ve taken from your experience in big law and government to your current corporate role at Plaid?

The best law firm lawyers are the ones who can discern a client’s goals and personality so they can formulate a strategy that fits that client. A big-name firm may be useful for the heft and workforce that they can bring to a matter, but I still want the lead lawyer to show they care about Plaid and Plaid’s long-term success.

As far as the government, I have become convinced that it is valuable to have people in government who understand how businesses work, and it is valuable to have former government personnel go to companies and help them make good decisions. I struggle with how to avoid the negative side of the revolving door, while not giving up the positive side of it.

When I left government, I specifically went in-house instead of to a law firm because I wanted to use my deep knowledge of the Dodd-Frank Act for good, in a business that can positively impact millions of people. I think that was a responsible decision.

How do you “network” effectively?

I have finally come around to acknowledging that personal brand matters, and that is one of the things that has opened doors for me throughout my career. A personal brand is how people think about you when you’re not around. I once attended a career development seminar where they showed a slide that said: Career Formula = Reputation + Performance + Network.

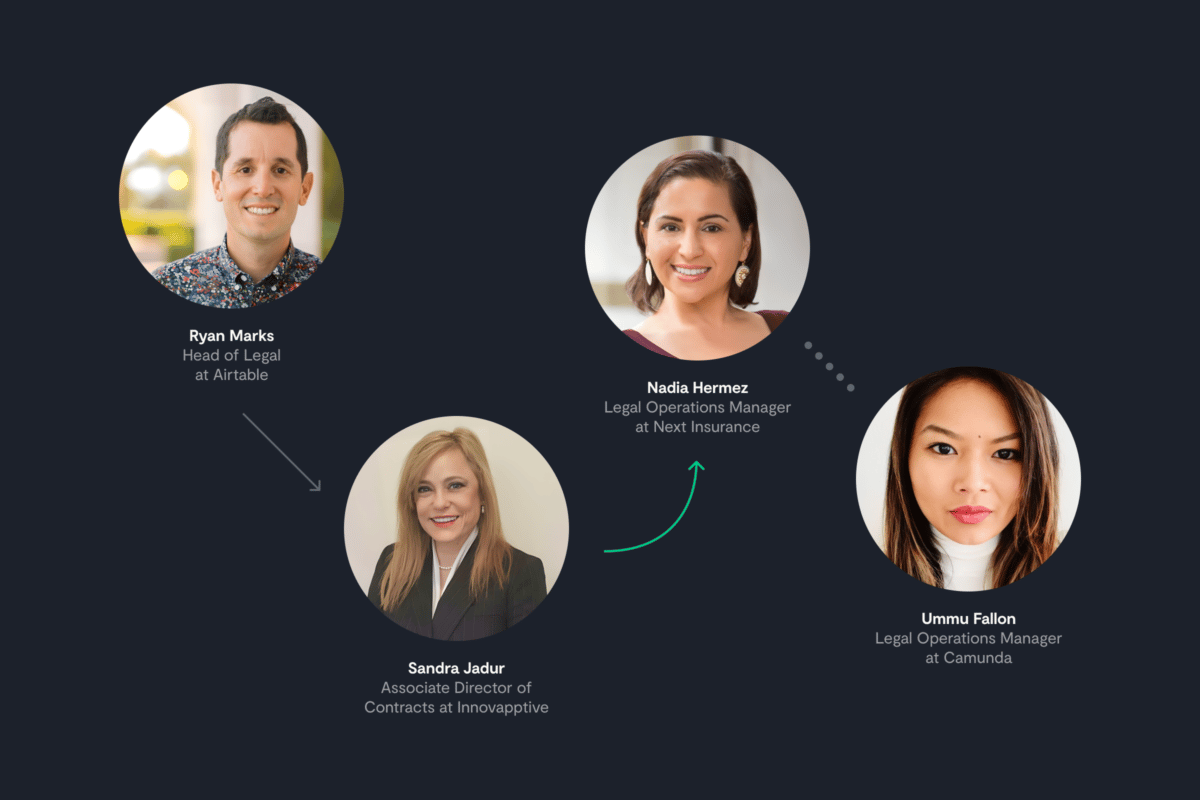

People in the room groaned. But, the hard reality is that *good* work is not the only thing that determines your success. Your performance has equal weight with your reputation and your network. This really hit home when I went to the Consumer Financial Protection Bureau. I really wanted to work at the new Consumer Bureau in 2010, but I assumed it would be very hard to get the job I wanted. As it turned out, my network and reputation kicked in without me even knowing it, and people felt confident recommending me for a senior role at the agency.

A good reputation comes from a great performance. If you act like you are interviewing for your next job every day, you will perform well and develop a good reputation. A network is simply the people you have encountered in your life. Your colleagues, opponents, friends, neighbors, and people you didn’t even realize noticed you. How can you build your reputation and network?

- Do great work and be great to work with;

- Join a bar committee and host an event;

- Lead or participate in a community service activity or a social event;

- Make lunch plans with people you admire or miss from a prior job;

- Join a professional or bar association committee.

Frankly, I just focus on being friendly, being an honest broker, keeping up with contacts, and following up on things. Without realizing it you will suddenly find that you have a network. That network will help when you are looking for a job, searching for great people to hire, or you need advice about something in your life and career.

How did you prepare for your first 90 days as GC?

There are many articles out there about what you need to know as a new GC. There are lots of foundational documents you would want to look at, and you quickly want to learn about any litigation, investigations, or high-risk matters.

Beyond that, however, my strategy is one I learned at Capital One. Listen, learn, and meet people. Unless the organization you join is in the midst of a crisis, most likely the people who are there are doing their best to do what they think is right. You will rub people the wrong way if you try to immediately change things; instead, approach the issues you see with an air of curiosity that recognizes the value of the work already being done.

In three GC roles, I started with a listening tour. I shared my background and then asked my team and key partners: “What do you need from me?”

Many of the answers did not make a lot of sense at first, but I went back to those notes as I learned more about the company and was able to better understand what people wanted me to help with. From those conversations, I looked for easy wins or things I could immediately unblock, but I did not try to do anything transformative in the first 90 days. Finally, I used those meetings to learn about people and establish relationships. Today, more than ever, when we are not physically in the same locations, those relationships are an important foundation for handling future shared challenges.

What does a typical day look like for you? What do you wish you had more time in the day for?

I go from meeting to meeting and topic to topic each day. One of the things I really value is team members who think ahead about prep for me and provide me succinct materials that I can digest. The constant pivoting can be exhausting, and anything that makes it easier is wonderful. I occasionally will block out a day just to catch up. It is on these non-meeting days (sometimes nights or weekends) that I can do deeper thinking or long-term projects.

Another thing I feel strongly about is not to let my email inbox or other people’s scheduling of meetings dictate my priorities. I try to always have long-term projects continuing alongside immediate deadlines, and I try to look ahead several weeks to see whether there are meetings I can decline or reschedule to make them more effective. As a practical example, at Plaid, I knew I wanted to enhance our systems and processes, but I also had more immediate legal issues to address. I made sure that the work on systems and processes got some of my time each month so that a year later I can look back and see that we have made progress on how we work in addition to addressing immediate issues.

Having a great EA is extremely helpful. I think of my EA as responsible in large part for my ability to be effective. It is an essential relationship also for keeping everything moving forward in the midst of whatever crisis or priority will take up my time. I feel really fortunate to have a great EA now at Plaid and to have had others in the past who showed me how valuable a partnership it could be.

What do you love the most about your role?

I love figuring out how to make things work better or enable great things to happen. My CEO once said that he appreciates it when he comes to me with a problem and my first reaction is, “Let me think about how we can accomplish that.”

It really is fun to find a solution to something. I try hard to put aside my pre-established views and solve problems from the ground up. It is also one of the reasons I really value diversity of opinion and people willing to challenge conventional thinking. Sometimes the solution to a problem comes out of the legal analysis, sometimes it comes from better communication, and oftentimes it is an open mind that allows me to see possible solutions. I guess this is also the essence of product development at a Fintech company like Plaid, where we have to be open to new ideas and methods of delivering financial service.

For the last 10 years, I have been in roles that directly impact consumers: as a regulator, a bank lawyer, and now a technology lawyer. I have felt good about being able to empower consumers to have control over their financial lives in every one of these roles. So much of our financial system is out of balance, and I love being part of efforts to make it possible for consumers to retake some of that power.

Can you share some of the challenges that are top of mind for you?

Cybersecurity is a consistent priority and should be for all GCs, especially those at technology or financial companies. I am a firm advocate of preparation and scenario testing to stay ahead of cyberattacks.

As we grow in size and complexity, another priority as a leader is ensuring our corporate infrastructure continues to support a great culture and be a model of inclusion and equity. I spend a lot of time these days talking to people about how to create connections with the company in an environment where we are not able to be as close to colleagues as in the past. I’d love to learn from others how they are approaching that challenge.

Finally, I also am always looking for ways to make the legal work satisfying for my team. Using technology and good processes to reduce mundane tasks is a big goal. In addition, I am always keen to evaluate our outside counsel to understand the quality of representation we get.

How do you keep yourself up to date so you can issue-spot effectively?

At times, I have been overwhelmed by the amount of information that I receive.

I now send almost all the newsletters, etc, to a separate email folder, so they do not distract me. I do pay attention to and attend law firm events that highlight new trends. For example, a couple of years ago I saw programs about ESG spring up and started to pay attention to it as a focus for corporate governance. I have learned, however, that I cannot be an expert in everything. So, I rely on hiring great people and asking them to keep our team apprised of important developments that could affect Plaid. Our space is full of regulatory shifts at the moment, so we pay particular attention to what financial and consumer regulators say about future policies.

In your role, working with product, sales, and the finance teams are key areas of responsibility. How do you manage priorities and set expectations?

Transparency and joint prioritization is the key. As much as possible, it is valuable to have a visible queue that the business can rearrange as their priorities change. It is also important for the business to forecast what is coming down the pike so we can adjust our support as needed.

Something I have struggled with, however, is how to forecast legal work on complex agreements. There are often externalities that we worry about, such as how aggressive the counterparty will be, how long they will take, and whether we can resolve issues internally or not.

Finally, we sometimes rely on quick escalation to avoid issues getting stuck for too long. I don’t love this, as it could feel disempowering to the folks assigned to the task. However, it provides an opportunity for a junior person to learn how more senior people balance risk and reward.

If you weren’t in legal, what would you do for a career?

Something in design. I almost went to art school, but I was too scared that I would not find a job when I finished college.

What is something people don’t know about you? Fun facts or secret talents?

I love to hike! I have a list of treks that I want to do, and I think it is time to start planning for them!

Do you have a mentor or mentor someone? What advice do you have to find one?

Mentor relationships are best when they are organic. Be authentic with people you think you can learn from and don’t be afraid to make offers to them, in addition to asking them for advice.

Is there a quote that motivates you?

Every day is the first day of the rest of your life.

.customer-story__wysiwyg h3 {font-size:18px; font-family:”Moderat-Bold”, sans-serif; max-width:100% !important; margin-top:80px !important;}

Ironclad is not a law firm, and this post does not constitute or contain legal advice. To evaluate the accuracy, sufficiency, or reliability of the ideas and guidance reflected here, or the applicability of these materials to your business, you should consult with a licensed attorney. Use of and access to any of the resources contained within Ironclad’s site do not create an attorney-client relationship between the user and Ironclad.