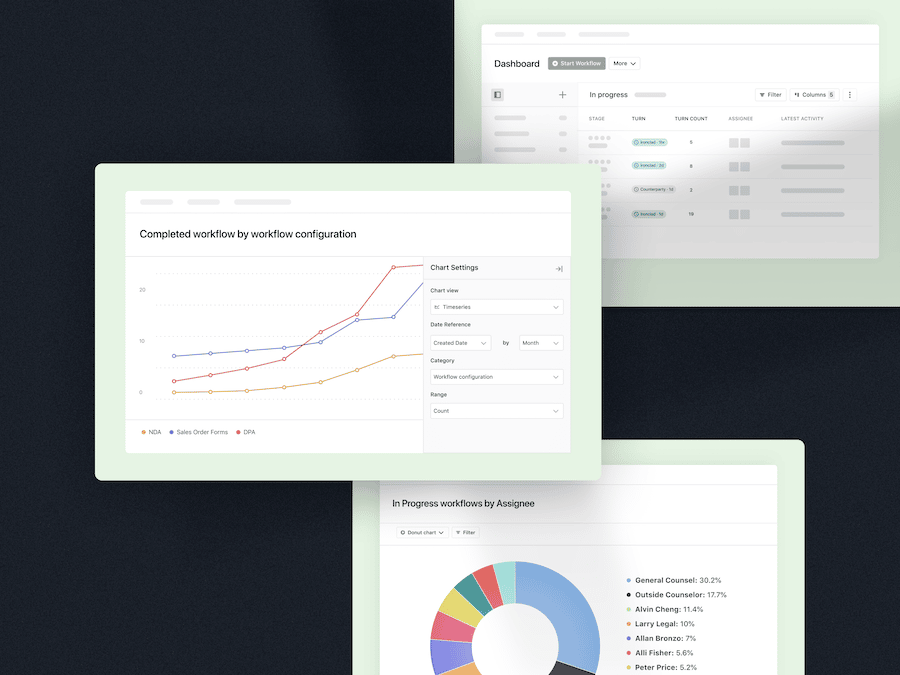

Contracts are treasure troves. And we’re not just talking about the business value–closed deals, revenue numbers, renewals–they represent. They also contain a wealth of information to help teams across the organization understand where they could be making better operational, structural, and financial decisions. For sales teams in particular, extracting insights from contract data and actively working them into sales processes can be the difference between a good quarter and a bad one. Organizations who use a CLM are well on their way to gaining this understanding, and those that use one with reporting and analytics functionalities are even further along. That’s why we built Ironclad Insights into our core CLM offering. It makes contract data analysis intuitive, shareable, and actionable via a customizable dashboards and robust AI-driven reporting and analytics capabilities.

While sales teams don’t typically spend much time in a CLM unless it’s integrated into a CRM like Salesforce, it’s important for them–and their leadership–to recognize the insights it can uncover, even if they’re requesting the information from their legal team and not exploring the platform themselves.

To that end, below are critical questions that sales teams can get answers to via Ironclad Insights to optimize their sales processes and drive revenue growth. Answering these non-exhaustive questions can tell teams:

- Which sales segments and governing law geographies you should focus your team’s resources–headcount, hours, tool licenses, etc.–on and when

- Which contract types are good candidates for switching to click-to-accept to speed up sales cycles

- Where in the sales cycle your contracts are getting stuck

- Which contract types which reps are better or faster at executing on than others

- How discounts and pricing variation affect contract value and renewal rates over time

- What terms and conditions generate the most pushback from counterparties

Contract Type Insights

Questions you can answer:

- How long does a contract type spend in each stage?

- What do negotiation rates look like for each contract type?

- What is the median contract value associated with a certain contract type?

- What do renewal rates look like for each contract type?

- How often are certain terms like liability and termination of convenience negotiated?

- What is the average number of times a contract type is redlined before finalizing?

By understanding where contracts are in the sales cycle, teams can identify a number of learnings and spot inefficiencies.They might use stage length information to forecast when a deal associated with a certain contract type will close. For example, if teams know that master service agreements (MSAs) for over $100k in the enterprise segment typically spend two months in review and one month in signature, they can surmise that an enterprise deal opened in Q1 will close at the beginning of Q2. This information is helpful for everything from provisioning headcount and organizing your sales team structure to forecasting revenue for the entire year.

On the redlining side, knowing the amount of times a certain type of contract is negotiated and over which terms can also provide insights into what aspects of your sales processes you might need to change. For example, if you know that over 60% of your contract types are negotiated or redlined less than 10% of the time, it might be a good indication to switch those contracts to click-to-accept agreements or implement a no negotiation threshold. Either of these, when implemented, would speed up review times and therefore deal cycles for at least half of your total contract volume. Additionally, if you know that of those <10% who do negotiate typically do so over a specific clause or term, leaders can take that learning to the legal team to explore alternative phrasing.

Segmentation & Pricing Insights

Questions you can answer:

- How does contract value break down by sales segment?

- How do renewal rates break down by sales segment?

- How does contract value (including discounts) correlate with contract lifecycle duration?

- Do the number of workflows launched for certain sales or customer segments change over a calendar year?

- How does the duration or contract value of a sales contract with certain terms and conditions compare to one without them?

Sales teams can use contract data to segment customers based on criteria like contract value, duration, product usage, and renewal rates. By understanding the executed contract characteristics of different sales segments, reps are able to tailor their account management accordingly. For example, if they know that renewal rates for their mid-market segment are around 40% for contract values below a certain threshold and below 10% for values above another threshold, they’ll be able to work backward backward from their goal and predict how many re-engagement actions they need to take to hit and exceed their numbers.

Leaders can also analyze historical contract data to understand which discounting and upselling strategies have been successful in the past for certain segments or contract types and identify pricing trends and optimal price points. To illustrate, take two segments: early-stage startups and later-stage startups. Businesses selling to later-stage startups will likely have more success offering a higher price point with fewer negotiations than an early-stage startup because the late-stage ones typically have more cash. The early-stage startup is also more likely to redline and negotiate heavily because their spending practices are under more scrutiny by board members and potential future investors. Without actual data, though, this is all conjecture. But if sales leaders compare negotiation rates within these segments over a given time period and correlate contract value, they’ll be able to get a more accurate picture to identify patterns and inform segment price points, establish best practices, adjust contract terms ahead of time, and hopefully close those deals faster.

Productivity Insights

Questions you can answer:

- How many of each type of contract does your sales organization typically execute?

- Are there geographical or business units that have a higher concentration of workflows executed than others?

- How much time does each rep spend on a given deal cycle?

What is the median internal turn time for a given contract type or workflow configuration? - How many contracts are up for renewal?

- What does the workflow creation cycle for sales agreements look like over a calendar year?

- How likely is it that a given sales contract will be approved or rejected by legal?

Taking a look at how contracts are launched and executed across your team can help you build an optimally designed sales organization. From a workload and resource allocation perspective, teams can organize themselves based on contracts launched and executed by segment, territory, deal size, speed of time to signature, and more and distribute assignments or resources accordingly. They can also use this information to accurately forecast sales.

On the performance evaluation side, nuanced contract execution data provides a quantifiable metric to evaluate the performance of individual sales reps. What’s more is that it provides contextual information around why that metric looks the way it does. For example, a rep might have over 60% of their sales contracts for the quarter launched but not executed, which may reflect poorly on the rep. However, after digging in further into what stage those 60% of contracts are stuck in, they might discover that the hold up is actually their commercial counsel team taking 17 days to turn around a contract instead of their promised SLA of 5 days. This uncovers that the inefficiency lies with the legal team, not the sales rep, and steps can be taken to mitigate.

Transforming Sales Teams With Contract Data

At a high level, granular contract data empowers sales teams to make informed decisions, optimize pricing and strategies, accurately forecast sales, identify up-selling opportunities, assess team performance, and much, much more. While we’ve gone over some of the key ways to slice and dice contract data via Ironclad Insights, it’s just the tip of the iceberg. To make use of all its bells and whistles, explore the platform for yourself and see what things you uncover–expected or otherwise–and see if it can take your sales team to the next level.

Ironclad is not a law firm, and this post does not constitute or contain legal advice. To evaluate the accuracy, sufficiency, or reliability of the ideas and guidance reflected here, or the applicability of these materials to your business, you should consult with a licensed attorney. Use of and access to any of the resources contained within Ironclad’s site do not create an attorney-client relationship between the user and Ironclad.

Ironclad is not a law firm, and this post does not constitute or contain legal advice. To evaluate the accuracy, sufficiency, or reliability of the ideas and guidance reflected here, or the applicability of these materials to your business, you should consult with a licensed attorney. Use of and access to any of the resources contained within Ironclad’s site do not create an attorney-client relationship between the user and Ironclad.